New Data on Homeownership by API Subgroups Uncovers Gaps by Ancestry

The diverse range of Asian, Pacific Islander, and Native Hawaiian communities in the United States represents many different languages and countries of origin. When these communities are grouped together into a single “Asian or Pacific Islander” (API) category, that aggregated group appears to do quite well by common measures of social and economic success. But looking at the data this way obscures important differences in experience – for example, among Native Hawaiians, third-generation Japanese Americans, and Burmese immigrants – and hides the particular challenges faced by many groups within that broader community.

On May 23, PolicyLink and the USC Program for Environmental and Regional Equity added new ancestry breakdowns to six indicators in the National Equity Atlas. This, the fourth in a series of analyses of the new data, examines the homeownership indicator.

This indicator is emblematic of the “American dream” and provides an important measure of family wealth and asset building. It also reveals vastly different outcomes among API subgroups. Of course, analyzing socioeconomic data cannot convey the range of chronic stresses caused by racism and stereotypes; but it can provide a better understanding of the diversity of experiences that exist within the API community in the United States.

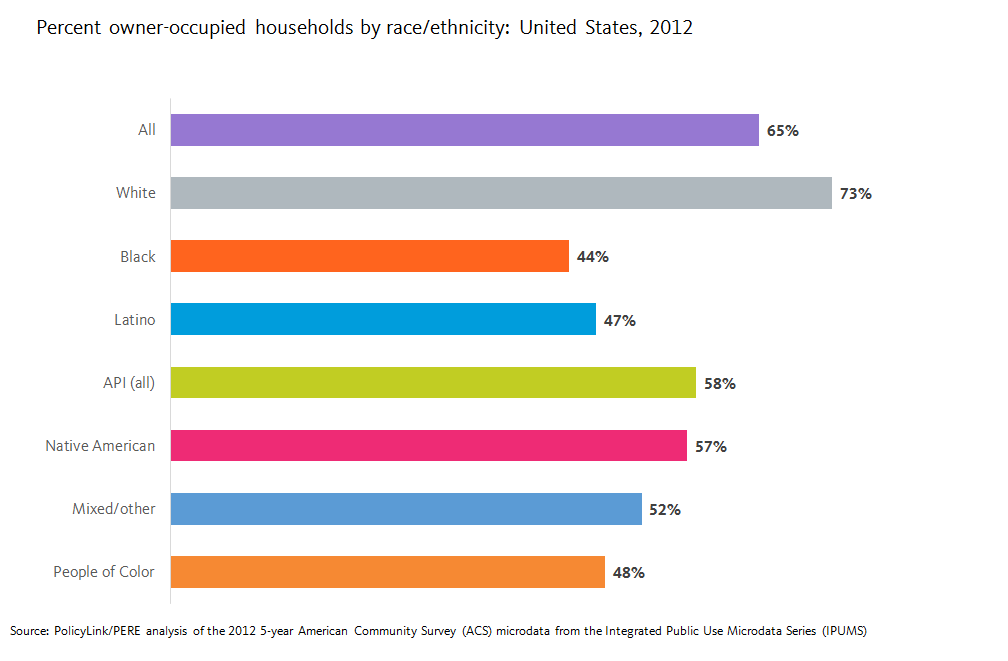

Homeownership Is Significantly Lower Among APIs than Non-Hispanic Whites

For many of the indicators of economic vitality and readiness included in the National Equity Atlas, Asians and Pacific Islanders and Native Hawaiians (APIs), as a group, appear to be doing better than their White counterparts. Compared to Whites, the API community earns higher median wages, achieves greater levels of educational attainment, and experiences lower rates of unemployment and youth disconnection. However, this trend does not extend to homeownership.

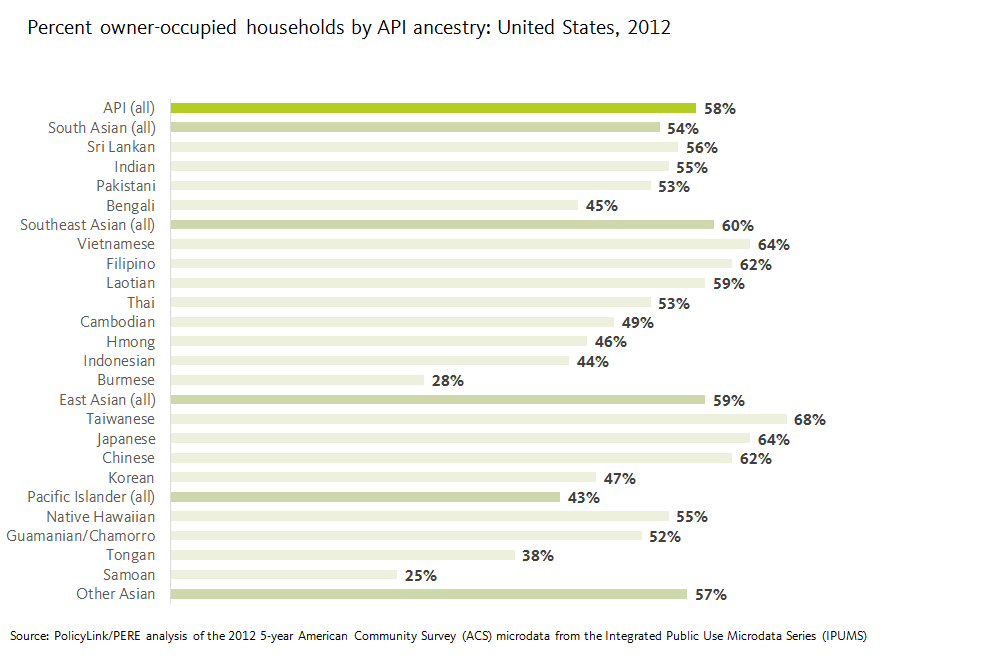

As the chart above illustrates, APIs have a homeownership rate of 58 percent — 10 percentage points higher than the rate for all people of color combined, but 15 percentage points lower than the homeownership rate of Whites (73 percent). Still, the relatively high rate of homeownership for APIs compared to other groups of color masks underlying differences within the diverse experiences of different API populations and reinforces the model minority stereotype.

What Does Examining Homeownership by Subgroup Tell Us?

Among all APIs, 58 percent of households are owner occupied. Between the various API subgroups, however, rates of homeownership vary widely. The lowest rates of homeownership are found among those of Samoan (25 percent), Burmese (28 percent), and Tongan (38 percent) ancestry. At the other end of the spectrum, the highest rates of homeownership are found among two Southeast Asian ancestry groups —Vietnamese (64 percent) and Filipino (62 percent) — and three East Asian groups: Taiwanese (68 percent), Japanese (64 percent), and Chinese (62 percent). But one East Asian group lags far behind the others: homeownership among people of Korean ancestry is just 47 percent.

Some of this difference may be explained by other factors related to family economic vitality: people of Korean ancestry attain average educational levels but earn lower median wages and experience higher rates of unemployment than other East Asian ancestry groups. Yet overall racial gaps in homeownership between Whites and APIs confirm that measures of education, employment, and wages do not necessarily predict homeownership rates.

Some of this difference may be explained by other factors related to family economic vitality: people of Korean ancestry attain average educational levels but earn lower median wages and experience higher rates of unemployment than other East Asian ancestry groups. Yet overall racial gaps in homeownership between Whites and APIs confirm that measures of education, employment, and wages do not necessarily predict homeownership rates.

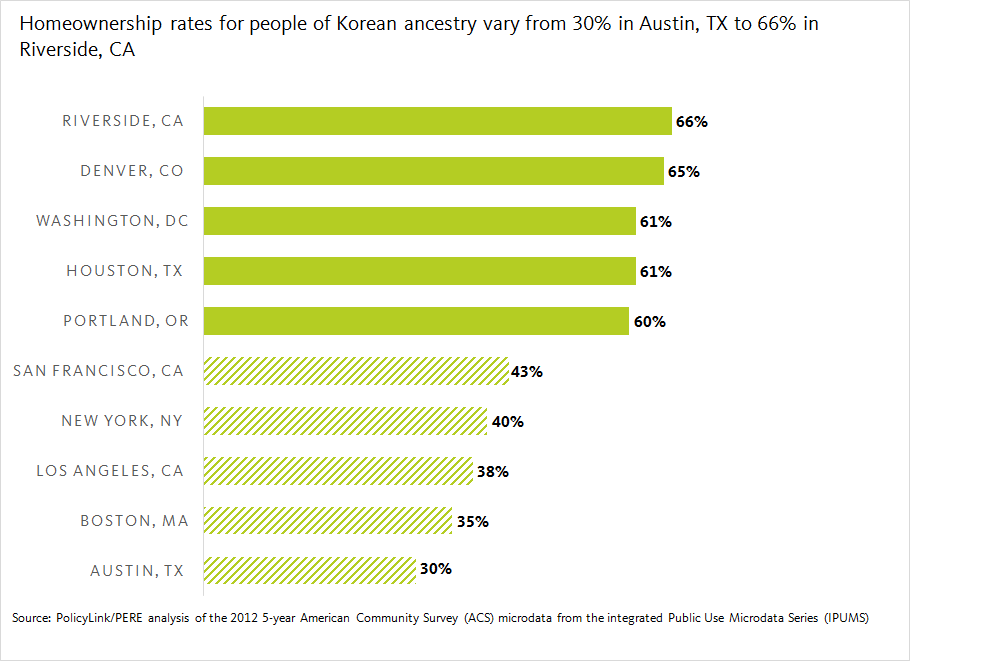

How Do These Patterns Differ Across U.S. Regions?

Even within a given ancestry group, of course, rates of homeownership are affected by a host of factors related to regional economic conditions, migration patterns, and local real estate markets. Among the U.S. regions with sufficient data to report homeownership rates for people of Korean ancestry, there are significant variations. Overall, these rates range from 30 percent in the Austin, Texas metro area to 66 percent in the Riverside, California metro area, as illustrated below. The five metro areas with the highest rates of homeownership among those of Korean ancestry are Riverside, California (66 percent); Denver, Colorado (65 percent); Washington, DC (61 percent); Houston, Texas (61 percent); and Portland, Oregon (60%) — all rates above the national average not only for the Korean subgroup but for all APIs.

It is perhaps not surprising that the five metro areas with the lowest rates of homeownership in the Korean ancestry subgroup, shown below, coincide with some of the most expensive real estate markets in the country: San Francisco, California (43 percent); New York, New York (40 percent); Los Angeles, California (38 percent); Boston, Massachusetts (35 percent); and Austin, Texas (30 percent). In these regions, homeownership among the Korean ancestry subgroup is well below the national average.

It is perhaps not surprising that the five metro areas with the lowest rates of homeownership in the Korean ancestry subgroup, shown below, coincide with some of the most expensive real estate markets in the country: San Francisco, California (43 percent); New York, New York (40 percent); Los Angeles, California (38 percent); Boston, Massachusetts (35 percent); and Austin, Texas (30 percent). In these regions, homeownership among the Korean ancestry subgroup is well below the national average.

Yet is also important to note that in each of these metro areas, homeownership among residents of Korean ancestry is also significantly lower than the regional rate of homeownship for all residents. In San Francisco, New York, and Los Angeles, there is a 12 percentage-point difference between the Korean subgroup and the regional average. In Boston, the gap is 27 percentage points. And in Austin, where overall homeownership is 58 percent, the gap is a staggering 28 percentage points.

Disaggregated Data Can Inform Tailored Housing Policy Solutions

Homeownership can be an important pillar of financial security and a tool for economic mobility for low- and middle-income families. But various social and market forces continue to produce barriers to homeownership for communities of color. Often these barriers are related to family income and assets, but redlining, discriminatory lending, and structural racism are also at play.

Disaggregated data can help advocates and policymakers identify the specific challenges that put homeownership out of reach for particular communities and identify strategies to alleviate them. This data makes clear that groups working on issues related to financial inclusion, asset building, and homeownership in a given region should identify whether particular groups are being left behind, work to identify specific barriers, and target outreach and resources to those who need them most. For example, In New York, Asian Americans for Equality provides homeownership support services through its community development fund, including multilingual counseling, outreach, and education in Cantonese, Mandarin, Spanish, and Korean.

Explore the status of homeownership in your city or region here.