Among the 10 Most Populous Cities, African Americans Remain Underrepresented in Business Ownership

Removing barriers that prevent people of color from starting and growing successful businesses is a crucial inclusive growth strategy. Entrepreneurship is an important pathway for building wealth and addressing the racial wealth gap, as well as for providing self-employment and income. Entrepreneurs of color also play a major role in creating employment opportunities: research shows that entrepreneurs of color are more likely to hire people of color and locate their firms in communities of color.

While businesses owned by people of color today make up a significant and growing share of businesses in cities across the country, entrepreneurs of color remain underrepresented in business ownership – particularly among high-revenue firms and firms with paid employees. Historic and present-day racial discrimination has contributed to racial inequities in business ownership and growth. The racial wealth gap makes it more difficult for people of color to start a business in the first place, and lack of access to capital adds to the challenge.

To help communities understand how they are doing on racial equity in entrepreneurship, the National Equity Atlas now includes four new indicators of entrepreneurship. These indicators are based on data from the Census Bureau’s Survey of Business Owners, a twice-a-decade survey designed to paint a picture of all firms — incorporated or not, with and without paid employees — with annual receipts of $1,000 or more by race, ethnicity, and gender. This survey represents the only data source with sufficient sample sizes to examine race and gender equity in entrepreneurship for all the geographies available in the Atlas, including the largest 100 cities. The latest data on the Atlas is from 2012 – after which point the survey was discontinued and is soon to be replaced by the Annual Business Survey.

Using this data, we examined the representativeness and growth rates of Black-owned businesses in the nation’s 10 largest cities (based on 2010 population) from 2007 to 2012. We focused on cities because many policies that foster entrepreneurship, from tax incentives to small business loan programs operate at the city level. We examined how the largest 10 cities measure up when it comes to measures of growth and success for Black-owned business. We focused only on firms with paid employees due to their greater economic impact on local economies.

Uneven Growth in Black-Owned Firms and Labor Force

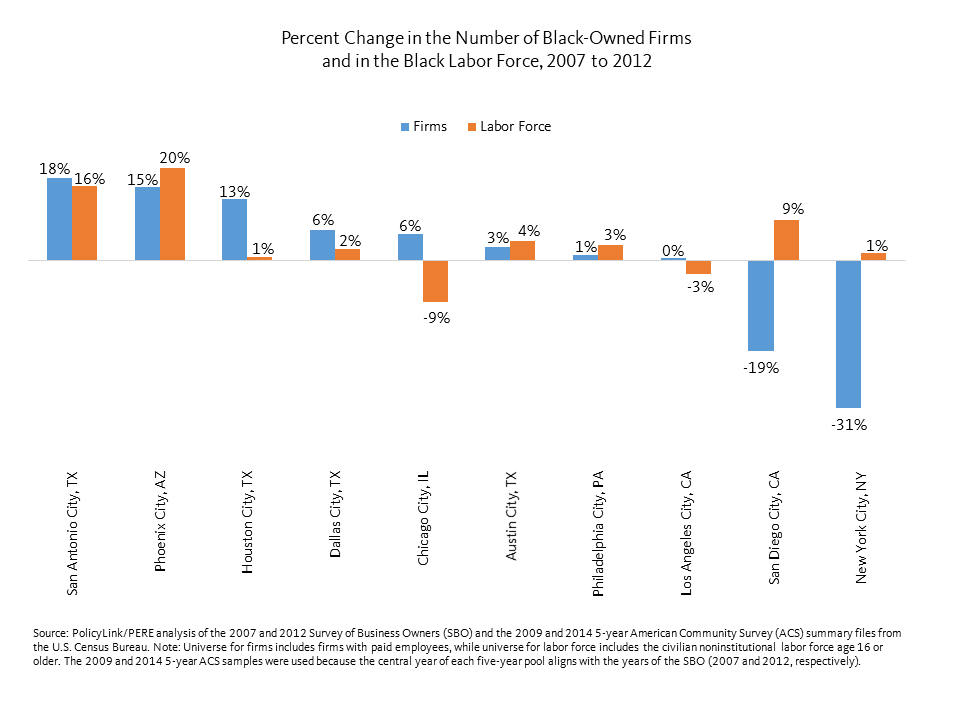

Nationally, the average growth rate for black-owned businesses with employees across the top 100 most populous cities was 19 percent. Across the top 10 cities, growth rates ranged from an increase of 18 percent in San Antonio to a decrease of 31 percent in New York City. Phoenix and Houston also had high growth in Black-owned businesses, while San Diego saw a decline of 19 percent.

Comparing the growth of Black-owned firms with the growth of the Black labor force (a proxy for potential business owners), we see that the two cities with the most firm growth also had the greatest labor force growth; San Antonio and Phoenix experienced growth rates upwards of 10 percent in both Black-owned firms and in the size of Black labor force. In Houston, however, there was strong growth in firms but minimal growth in the Black labor force, indicating a rise in the rate of business ownership. On the other end of the spectrum, New York and San Diego saw rapid declines in the number of Black-owned firms alongside growth in the labor force, suggesting a decline in the rate of business ownership. Overall, the relationship between the two measures is weak, suggesting that growth in Black-owned firms is not simply a function of growth in potential business owners.

Black/White Differences in Business Ownership

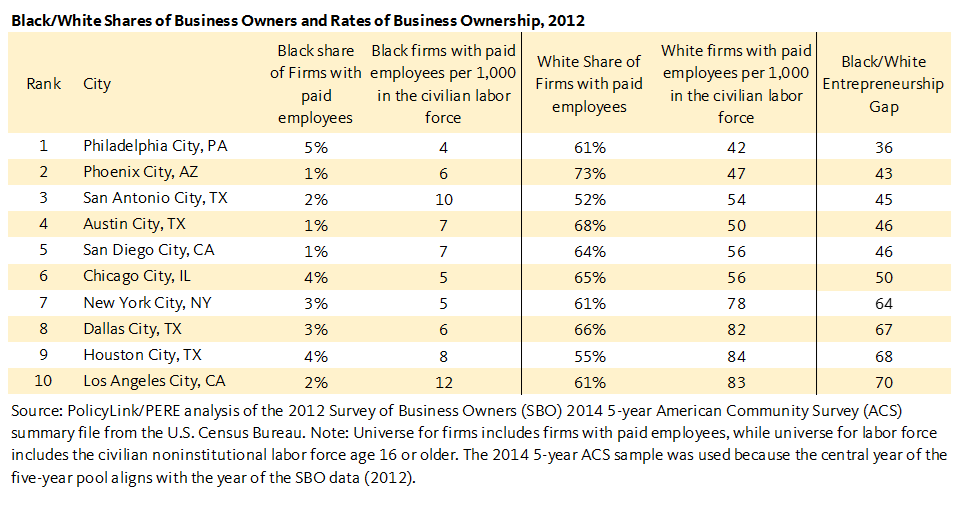

To compare rates of Black and White entrepreneurship across cities, we can look at the number of firms per 1,000 people in the labor force. Examining the 10 largest cities, there is variation in the rates of entrepreneurship in general — that is, rates for both the Black and White populations are relatively higher in Los Angeles and Houston, and relatively lower in Philadelphia and Chicago – but also the rates for the White population are substantially higher than those for the Black population. Los Angeles is the city with the highest number of Black-owned firms with paid employees per 1,000 in the civilian labor force but it also has the largest Black/White entrepreneurship gap at 70 points — meaning that there are 70 more business owners per 1,000 people in the labor force among the White population. This racial gap appears to be driven by the level of White entrepreneurship — influenced by the fact that often White entrepreneurs have more generational wealth and easier access to the financial capital needed to start a business. Philadelphia has the lowest rates of entrepreneurship for both the White and Black populations, along with the smallest entrepreneurship gap of 36 points.

Declining Revenues for Black-owned Firms

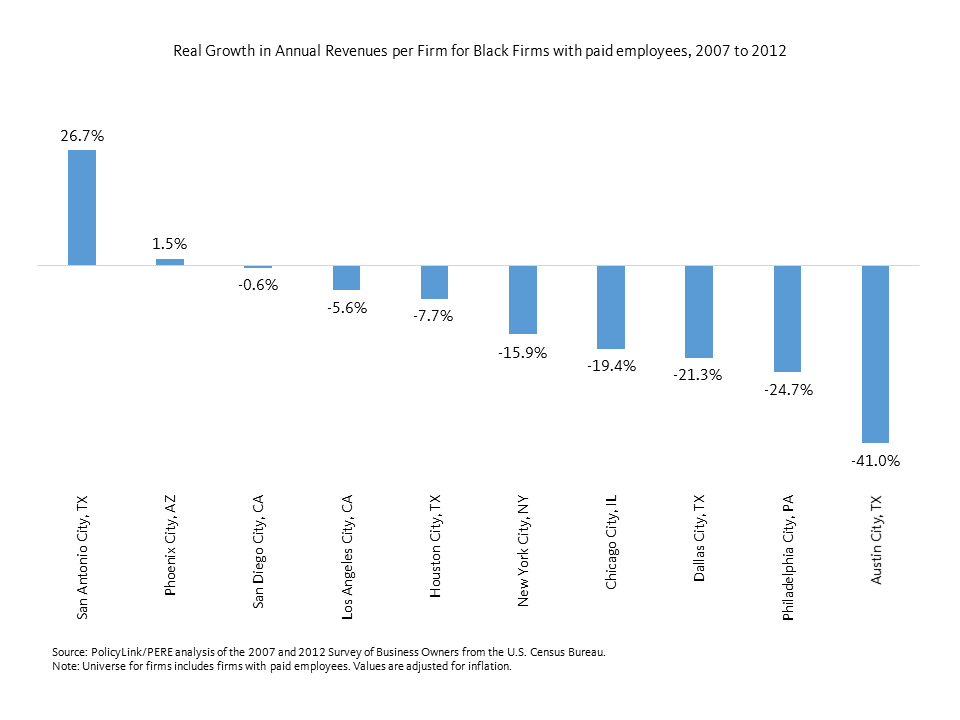

Our most populous cities had mixed success in terms of revenue growth for Black-owned firms, but they declined in eight of the largest 10 cities between 2007 and 2012. The only two cities that saw increases in (inflation-adjusted) revenues per firm for Black-owned firms with paid employees were San Antonio at 26.7 percent (an average increase of about $140,000 per firm) and Phoenix at 1.5 percent (an average increase of about $12,000 per firm). Austin and Philadelphia saw the largest declines in revenues at 41.0 percent and 24.7 percent.

Diverging Growth in Employee Pay Among Black-owned Firms

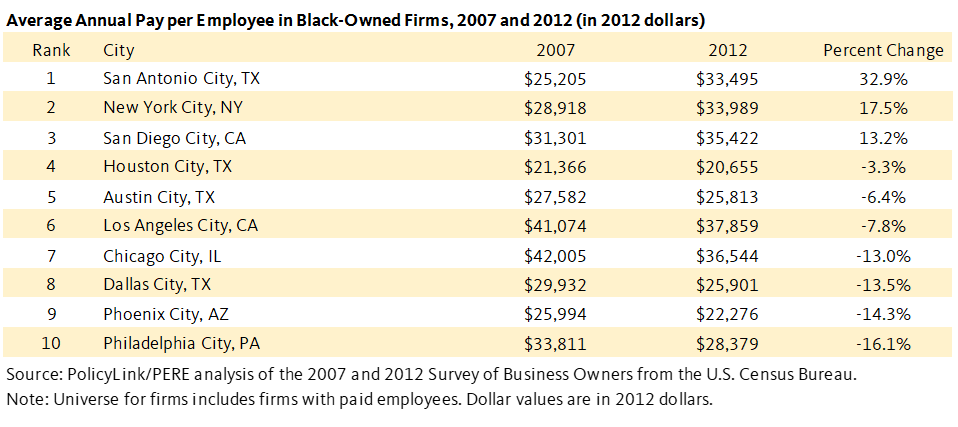

Another important measure of understanding how well Black-owned businesses are doing is whether they are able to increase pay for their workers over time. This is particularly important given that employee pay among Black-owned firms is generally much lower than in other firms, and because Black-owned firms are more likely to hire Black workers, the ability to increase pay can have a positive impact on the racial earnings gap. For a sense of how far behind Black-owned firms are in the wages they are able to provide, the Survey of Business Owners reports average pay per employee for the United States in 2012 of about $37,400 and the average pay per employee for Black-owned firms of only about $28,400.

Looking at inflation-adjusted annual pay per employee for Black-owned firms between 2007 and 2012, we see that annual pay per employee for Black-owned firms only grew in three of the largest 10 cities — San Antonio (32.9 percent ), New York (17.5 percent), and San Diego (13.2 percent). In contrast, Black-owned businesses saw the greatest declines in annual pay per employee in Philadelphia (-16.1 percent), Phoenix (-14.3 percent), Dallas (-13.5 percent), and Chicago (-13.0 percent).

In addition to per employee pay, San Antonio also scored well on other metrics including experiencing the greatest growth in annual sales for Black-owned firms, one of the lowest White/Black Entrepreneurship gaps, and among the largest increases in the number of Black-owned firms and the size of the Black labor force. This diverged from New York and San Diego where annual pay per employee grew despite declines in the labor force. New York was a particularly interesting case because wages grew even while the city had the seventh highest Black/White entrepreneurship gap.

A Need for Equitable Entrepreneurship Strategies

Across the 10 largest cities, there were large racial gaps in Black and White business ownership everywhere, but some cities did show better performance than others. San Antonio showed consistent positive signs for Black-owned businesses on all measures examined: growth in firms, revenues per firm, employee pay, and Black/White gap in entrepreneurship. Meanwhile, New York showed consistent negative signs with the greatest decline in the number of firms, declining revenues per firm, and one of the largest Black/White entrepreneurship gaps.

Certain factors that are associated with increased success in entrepreneurship include wealth, access to capital, and formal and experience-based human capital, which can consist of formal education or experience running family-owned business. Policies and programs that address any of these barriers should help to increase the number of Black business owners and support their long-term success. Finally, incentive programs that lower financial barriers to entry for Black entrepreneurs could help foster business ownership.

To access data on entrepreneurship for your city, region, or state; and to learn more about policies to expand business ownership for entrepreneurs of color, see the four new indicators available in the Atlas: Firm Diversity, Revenues, Business growth, and Revenue growth.